IRIS Reporting Breakdown

September 19, 2018:

Academic medical centers are required to submit to Medicare their Intern and Resident Information System (IRIS) report with their yearly cost report filing. The IRIS report is used to calculate the amount of reimbursement the hospital will receive for the direct and indirect costs of the Graduate Medical Education programs. The IRIS report contains information regarding all residents that are training at the hospital and enrolled in a Medicare approved program. For IRIS reporting purposes, the residents’ time is measured in FTEs. The FTE is the full time equivalent it will take a resident to complete one year of training. 1.0 FTE is equal to 365 or 366 days.

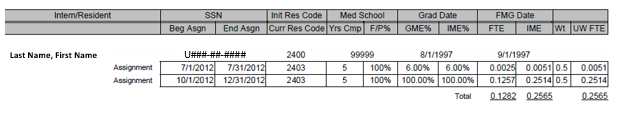

Below is a sample of a resident reported on the IRIS report.

Let’s now examine each section of the sample resident’s data reported on the IRIS. The information in brackets is the referenced data from the sample resident’s data above:

Resident Name: [Last Name, First Name] – Enter the resident’s first and last name. A middle initial can also be included.

Resident Social Security Number: [U###-##-####] – The Social Security Number is the identifier Medicare uses to check for overlapping claims between hospitals. Each Social Security Number issued by the United States should begin with the letter “U” and each Social Security Number issued by Canada should begin with the letter C.

Initial Residency Code: [2400] – Each Medicare approved residency is assigned a residency code, for example, the residency code for Anesthesiology is 1100, Internal Medicine is 1400 and Radiology is 2400. The code that is assigned for the resident’s initial residency code is based on the first Medicare approved graduate medical education program the resident is enrolled. There are some exceptions for residents that were enrolled in a transitional year or simultaneously matched into a PGY-2 year prior to beginning graduate medical education training. This entry in the IRIS is very important because it can significantly impact the Direct Graduate Medical Education Medicare payment.

Medical School: [99999] – Each medical school and dental school in the United States, Canada and Puerto Rico are assigned a five-digit code. If the resident graduates from a medical school that is outside the United States, Canada or Puerto Rico, the medical school code used is 99999.

Grad Date: [8/1/1997] – This is the resident’s date of graduation from medical school and should be taken directly from the resident’s medical school diploma.

FMG Date: [9/1/1997] – This is the date the resident that graduated from a medical school outside the United States, Canada or Puerto Rico, received his/her ECFMG certificate.

Assignment Dates: [7/1/2012-7/31/2012 and 10/1/2012-12/31/2012] – The hospital is to report the beginning and end of each assignment during the cost reporting year that the hospital is eligible to claim for direct and indirect costs. Please note, academic year (i.e. July 1 through June 30) does not always match the cost reporting year. There are many hospitals across the nation that have a cost reporting year that matches the academic year. Other hospitals have a cost reporting year based on a different calendar, most commonly January 1 through December 31 and October 1 through September 30.

Current Residency Code: [2403] – This is similar to the Initial Residency Code, but instead of identifying the first program in which the resident is enrolled, it identifies the current program in which the resident is enrolled.

Years Completed: [5] – This is the number of approved graduate medical education program years the resident has completed as of the resident’s training date.

Full/Part Time Percentage: [100%] – For most residents, the percentage should be 100%. If the resident is only enrolled part time, this percentage should be reduced to the appropriate percentage of time enrolled in the program.

GME Percentage: [6% and 100%] – As previously indicated, Medicare reimburses hospitals for the Direct Graduate Medical Education costs and the Indirect Graduate Medical Education costs. The GME percentage is the percentage of time during the particular assignment dates that the hospital is eligible to claim Medicare Direct Graduate Medical Education payments.

IME Percentage: [6% and 100%] – Likewise, the IME percentage is the percentage of time during the particular assignment dates that the hospital is eligible to claim Medicare Indirect Graduate Medical Education payments.

Calculated IME FTE: [0.0051 and 0.2514 (under the “IME” Column)] – The IME FTE is calculated by multiplying the number of assignment days by the IME Percentage and dividing by the number of days in a year (365 or 366).

Calculated DGME Unweighted FTE: [0.0051 and 0.2514 (under the “UW FTE” Column)] – The DGME Unweighted FTE is calculated by multiplying the number of assignment days by the GME percentage and dividing by the number of days in a year (365 or 366).

Weight: [0.5] – For all residents that are within their Initial Residency Period (“IRP”), the resident is weighted by 1.0. For all residents that are outside their IRP, the resident is weighted by 0.5. In a future newsletter we will discuss how one can identify and calculate a resident’s Initial Residency Period.

Calculated DGME Weighted FTE: [0.0025 and 0.1257 (under the “FTE” Column)] – The DGME Weighted FTE is calculated by multiplying the Unweighted DGME FTE by the resident’s weight (i.e. 1 or 0.5).

About the Author:

Sarah Ottesen

626-656-8312

sarah@gmesolutions.com