Claiming Nonprovider Locations

March 14, 2018:

In order to claim nonprovider locations on your IRIS report, there are several additional rules that you must consider. Our hope for you is that by the end of this article you will be able to identify if a facility is considered a nonprovider location, if the training in which the residents are participating is claimable for GME and IME, and the type of documentation that is needed to support the claim.

How to Identify a Nonprovider Location

There is no direct definition in the GME and IME sections of the regulations. However, 42 CFR § 413.78(g) provides examples of nonprovider settings, which include “freestanding clinics, nursing homes, and physicians’ offices”. Furthermore, 42 CFR § 415.152 defines a nonprovider setting as “a setting other than a hospital, skilled nursing facility, home health agency, or comprehensive outpatient rehabilitation facility in which residents furnish services. These include, but are not limited to, family practice or multispecialty clinics and physician offices.”

Now that we can better identify if a facility is considered a nonprovider location, let’s discuss the types of rotations that are claimable.

Types of Rotations at Nonprovider Locations

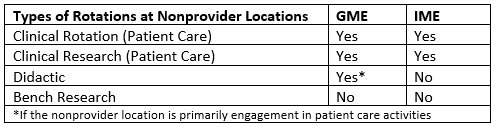

CMS is much clearer in defining the types of rotations at the nonprovider location that are claimable for GME and IME Medicare reimbursement. Under the current regulations, 42 CFR § 413.78(g) (GME) and 42 CFR § 412.105(f)(ii)(E) (IME), the time residents spend in nonprovider locations may be claimed if the resident is engaging in “patient care activities, as defined in 42 CFR § 413.75(b)”. The Federal Register (Vol 66, No. 148/Wednesday, August 1, 2001, 39897) provides additional guidance on clinical research and bench research. It states that clinical research is a patient care activity. Bench research is explicitly not counted for both DGME and IME at nonprovider locations. Finally, as stated in 42 CFR § 413.78(g), didactic activity can be claimed for GME as long as the nonprovider location is primarily engaged in furnishing patient care activities. Below is a summary of the rules:

Type of Documentation Needed to Support the Claim

In order to claim time in a nonprovider location, the hospital must have incurred the residents’ salaries and fringe benefits, including travel and lodging where applicable. This is one of the biggest changes in the regulations surrounding nonprovider locations. No longer will the hospital need to prove that it is incurring substantially all of the training costs; it only needs to be able to show that it incurred the residents’ salaries and fringe benefits. There are two ways the hospital can show this, as stated in 42 CFR § 413.78(g)(3): “The hospital or hospitals must comply with one of the following:

- The hospital or hospitals must incur the costs of the salaries and fringe benefits of the resident during the time the resident spends in the nonprovider setting by the end of the third month following the month in which the training in the nonprovider site occurred.

- There is a written agreement between the hospital or hospitals and the outside entity that states that the residents’ salaries and fringe benefits (including travel and lodging where applicable) during the time the resident spends in the nonprovider setting is to be paid by the hospital(s). Hospitals may modify the amounts specified in the written agreement by the end of the academic year (that is, June 30) to reflect that the costs of the training program in the nonprovider site have incurred.”

We hope that you now feel confident in identifying the types of nonprovider locations and rotations that can be claimed on the IRIS.

About the Author

Sarah Ottesen

626-656-8312

sarah@gmesolutions.com