Incorrect FTE Reporting Could Penalize Your Hospital

October 16, 2018

September’s newsletter provided a breakdown of the Intern and Resident Information System (IRIS) report. This newsletter will focus on one of the most important stats in the IRIS Report — the initial residency program. The initial residency program is important because it generates the initial residency period, which we will refer to as the “IRP”.

Since most hospitals are well over their FTE cap, you may be wondering why you should strive to correct such a common issue. Although it seems illogical, because of the way CMS applies the Direct Graduate Medical Education (DGME) FTE cap, when a hospital is over its FTE cap and trains residents outside their IRP, they will not be able to reach their FTE cap and, therefore, will be penalized in its DGME Medicare Reimbursements.

For all resident training within the IRP, the hospital can claim the resident at a weight factor of 1.0. Residents training outside the IRP can be claimed at a weight factor of 0.5, half of the full FTE. For example, if a resident’s initial residency program is in Internal Medicine, their initial IRP is 3 years. During the resident’s first, second and third year of graduate medical education (GME) training, they will have a weight factor of 1.0 on the IRIS report. When the resident enters their fourth year and for every subsequent year, unless enrolled in a program with exceptions to the IRP, they will have a weight factor of 0.5 on the IRIS report.

As previously mentioned, there are several exceptions:

Match Exception – If a resident matched to a second year specialty program prior to beginning the first year of approved GME training, the initial residency program and IRP would be the program they matched into for their second year of training.

Transitional Year Program Exception – If a resident’s first year of training is in a transitional year program or a traditional rotating internship, CMS will use the second year of training to determine the initial residency program and IRP, even if the resident did not match into the second year.

- Geriatric residents are considered to be within the IRP for up to 2 additional years.

- Preventive Medicine residents are considered to be within the IRP for up to 2 additional years.

- Child Neurology residents will have an IRP of 5 years.

- If the resident is enrolled in a combined residency program made up of all primary care or obstetrics-gynecology programs, the resident’s IRP is the longer of the individual programs’ IRPs plus 1 additional year. If the combined residency program is not made up of all primary care or obstetrics-gynecology programs, then the resident’s IRP is the longer of the individual programs’ IRPs.

To help illustrate how a hospital over its FTE cap is being penalized, consider the following example:

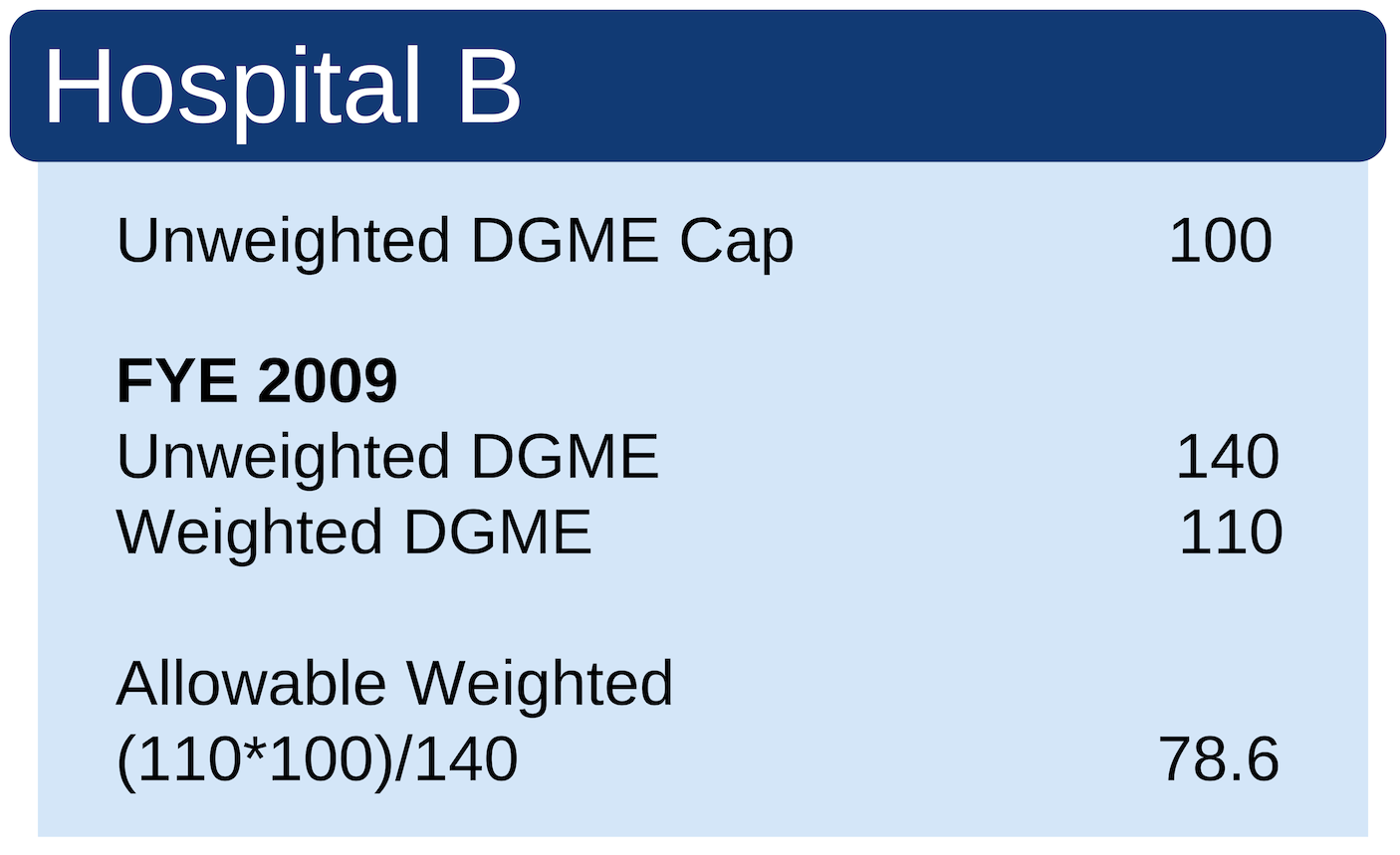

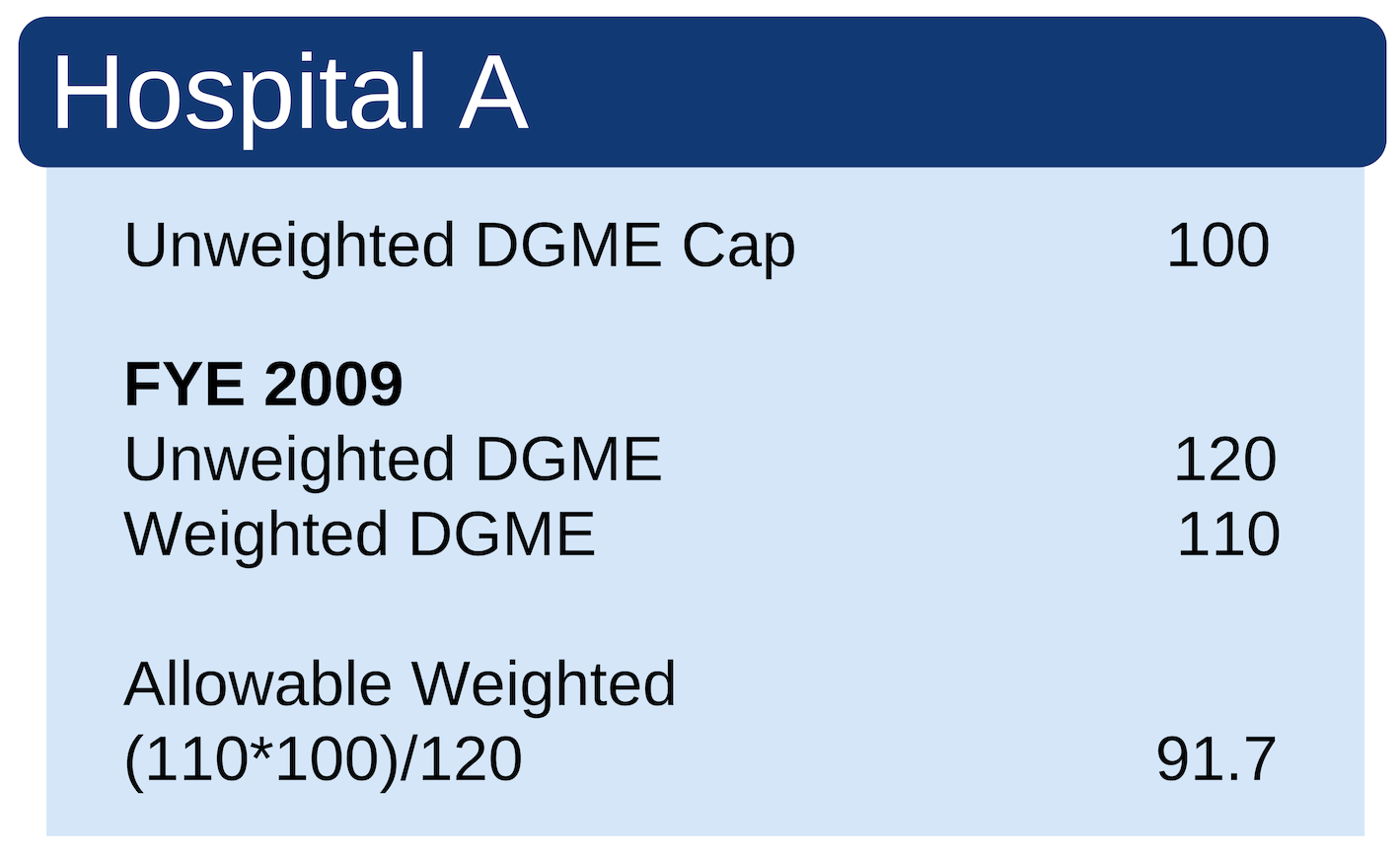

Both Hospital A and Hospital B have an Unweighted DGME Cap of 100. Additionally, during the current year, both Hospital A and Hospital B have weighted FTE totals of 110. One may predict that because the Unweighted DGME Cap is the same for each hospital (100 FTEs) and the weighted FTE totals are the same for each hospital (110 FTEs), the allowable weighted FTE total would be the same.

However, we have left out a crucial factor. In this instance, relative to its overall training, Hospital B trained a higher percentage of fellows (i.e. residents outside their IRP) than Hospital A and, therefore, has a higher unweighted FTE count. So, Hospital B’s current year unweighted DGME count was actually 140 FTEs, while Hospital A had 120 unweighted DGME FTEs.

In applying the FTE cap, Hospital A would have an adjusted weighted FTE of 91.7 (110*100/120), while Hospital B would have an adjusted weighted FTE of 78.6 (110*100/140).

As you can see, even though Hospital A and Hospital B had the exact same DGME Cap limit and current year weighted FTE totals, the additional weighted residents that Hospital B trained caused its overall allowable FTEs to be less.

GME Solutions can complete a review of IRIS reports in all reopenable cost reporting years to ensure the weighted counts are reported accurately. GME Solutions bases its fees on a contingency, therefore, there are no upfront costs to the hospital.

Additionally, GME Solutions has created a group appeal to challenge Medicare’s application of the DGME FTE Cap. We can provide you with a free impact analysis of your hospital’s DGME FTE Cap to determine how your hospital could be penalized.

Contact us for a free impact analysis or additional information regarding the IRIS review by clicking here.

About the Author:

Sarah Ottesen

626-656-8312

sarah@gmesolutions.com