Proposed Changes to Medicare Hospital Inpatient Prospective Payment System (IPPS) for CY 2024

CMS published its proposed rule for Federal Fiscal Year 2024 on May 1, 2023 in the Federal Register.

You can find the Proposed Rule here »

- Calculation of Prior Year IME Resident-to-Bed Ratio When There is a Medicare GME Affiliation Agreement

- Training in New Rural Emergency (REH) Facility Type

- Notice of Closure of St. Vincent Charity Medical Center

- Reasonable Cost Payment for Nursing and Allied Health Education Programs

Calculation of Prior Year IME Resident-to-Bed Ratio When There is a Medicare GME Affiliation Agreement

The first is regarding the calculation of the Prior Year Indirect Medical Education (IME) Resident-to-Bed Ratio. CMS is providing a clarification of the cost report instructions concerning the adjustment that is allowed when a hospital has an increase in its current year FTEs and FTE cap due to an affiliation agreement:

If the provider is participating in a Medicare GME affiliation agreement or rural track Medicare GME affiliation agreement under 42 CFR 413.79(f), and the provider increased its current year FTE cap (difference of current year line 8 and prior year line 8 is positive) and increased its current year allowable FTE count (difference of current year line 12 (excluding current year dental and podiatry from line 11) and prior year line 12 (excluding prior year dental and podiatry from line 11) is positive) due to this affiliation agreement, identify the lower of: a) the difference between the current year numerator line 15 and the prior year numerator line 12 of the prior year cost report, and b) the number by which the FTE cap increased per the affiliation agreement (difference of current year line 8 and prior year line 8), and add the lower of these two numbers to the prior year’s numerator line 12 of the prior year cost report.

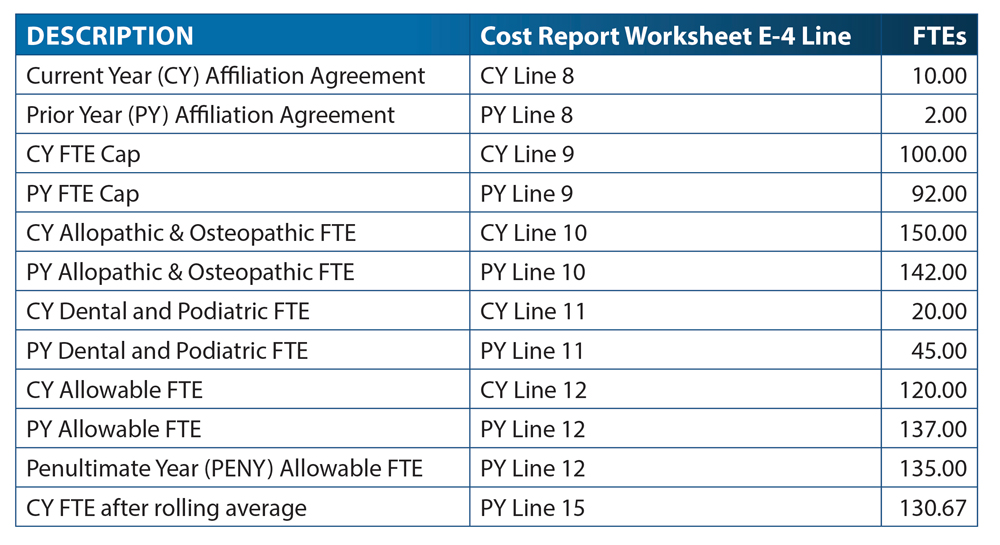

GME Solutions does not agree with these proposed changes and urges hospitals to submit a comment by Friday, June 9th. GME Solutions finds fault with calculation of the adjustment. Specifically, the calculation of “a)”, “the difference between the current year numerator, Line 15 and the prior year numerator, line 12 of the prior year cost report”. This calculation is not comparing two like facts. The current year FTE listed on Line 15 is an FTE that is an average of the current, prior year and penultimate year allowable FTEs, which all include dental residents. Line 12 of the prior year cost report is the prior year’s allowable FTE including dental residents. Below are two scenarios of why the difference between these two numbers is not a representation of the impact an affiliation agreement has on the current year as compared to the prior year:

Scenario #1: Dental residents decreased in current year:

In this scenario, though the hospital’s current year had an increase in the affiliation agreement of 8 FTEs and an increase in the current year FTE count by 8 FTEs, the hospital would not receive an adjustment under the new clarification because one must add to the prior year FTE the lower of “a) the difference between the current year numerator line 15 and the prior year numerator line 12 of the prior year cost report, and b) the number by which the FTE cap increased per the affiliation agreement (difference of current year line 8 and prior year line 8).” In the scenario listed above, the lower of the two facts would be “a)”, and that number is actually less than 0, 130.67 – 137.00.

Scenario #2: Penultimate Year FTEs were lower than the prior year and the current year:

In this scenario, though the hospital’s current year had an increase in the affiliation agreement of 8 FTEs and an increase in the current year FTE count by 8 FTEs, the hospital would not receive an adjustment under the new clarification because one must add to the prior year FTE the lower of “a) the difference between the current year numerator line 15 and the prior year numerator line 12 of the prior year cost report, and b) the number by which the FTE cap increased per the affiliation agreement (difference of current year line 8 and prior year line 8).” In the scenario listed above, the lower of the two facts would be “a)”, and that number is actually less than 0, 90.67-92.00.

Instead of the proposed clarification, GME Solutions suggests that CMS uses the following language for clarification:

If the provider is participating in a Medicare GME affiliation agreement or rural track Medicare GME affiliation agreement under 42 CFR 413.79(f), and the provider increased its current year FTE cap (difference of the sum of current year line 7.02 and line 8 and the sum of prior year line 7.02 and line 8 is positive) and increased its current year FTE count (difference of current year line 10 and prior year line 10 is positive) due to this affiliation agreement, identify the lower of: a) the difference between the current year line 10 and the prior year line 10 of the prior year cost report, and b) the number by which the FTE cap increased per the affiliation agreement (difference of the sum of current year line 7.02 and line 8 and the sum of prior year line 7.02 and line 8), and add the lower of these two numbers to the prior year’s numerator line 12 of the prior year cost report.

The suggested change in the language will provide a direct comparison that does not include dental and podiatric FTEs nor is it impacted by prior year and penultimate year statistics.

Again, GME Solutions does not agree with these proposed changes and urges hospitals to submit a comment by Friday, June 9th. At the following link you will find a template that your hospital can revise, sign and submit.

Submit Here »

Training in New Rural Emergency (REH) Facility Type

Secondly, CMS is proposing to allow a hospital to include FTE residents training at an (REH) in its DGME and IME FTE counts as long as it meets the nonprovider setting requirements. Alternatively, the REH can decide to continue to incur the costs of training residents in an approved residency training program(s) and receive payment based on 100 percent of the reasonable costs for those training costs. In this case, the hospital cannot include the resident training in the FTE count. This is similar to CMS’ policy for Graduate Medical Education payments for training at a Critical Access Hospital (CAH).

Notice of Closure of St. Vincent Charity Medical Center

CMS has used the CY 2024 IPPS Proposed Rule to announce another round of applications for Section 5506 of the Affordable Care Act, FTE redistribution of cap slots from closed hospitals. Applications for Round 20 are a result of the closure of St. Vincent Charity Medical Center, located in Cleveland, OH. There will be 64.66 DGME FTE cap slots and 56.73 IME FTE cap slots distributed.

Hospitals interested in these slots must submit applications using the electronic application intake system, Medicare Electronic Application Request Information System (MEARIS) no later than July 10, 2023. The Section 5506 application can be accessed here »

Reasonable Cost Payment for Nursing and Allied Health Education Programs

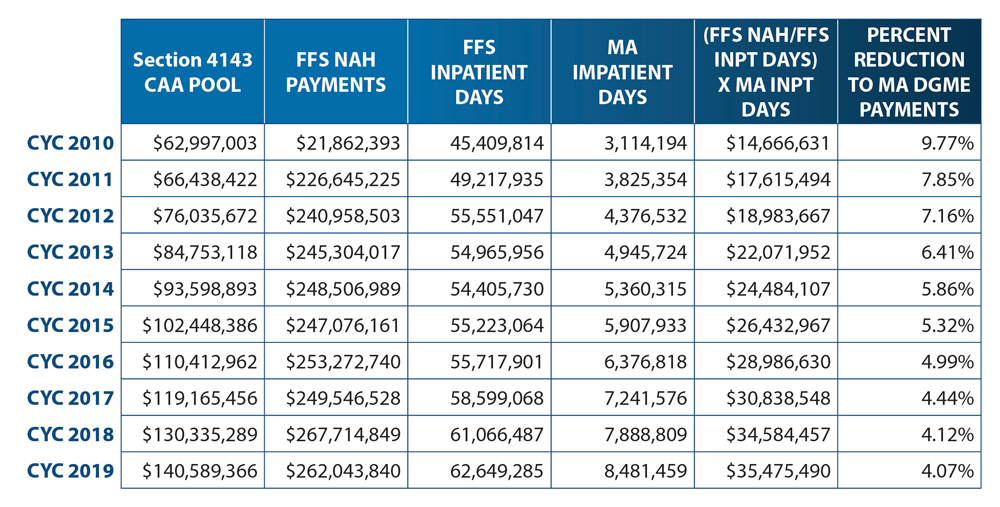

CMS has revised its tables associated with the calculation of payments for the Nursing and Allied Health Education (NAH) programs for Medicare Advantage(MA) enrollees. The total spending for these programs will no longer be capped at $60 million for any calendar year. CMS has instructed the Medicare Contractors (MAC) to recalculate NAH payments for cost reporting periods between 2010 and 2019 that are still within the 3-year reopening period. In addition, if the Hospital, closed all of its NAH programs prior to December 29, 2022 it would not be eligible for the additional payments based on the table below.

Calculation Table for Section 4143 of CAA of 2023

About the Author:

Sarah Ottesen

Senior Principal

sarah@gmesolutions.com