Claiming Resident Time in Inpatient Psychiatry & Rehabilitation Facilities

December 11, 2018

If residents are enrolled in a Medicare-approved program and rotate into the Inpatient Psychiatry Facility (IPF) or the Inpatient Rehabilitation Facility (IRF), they cannot be claimed for Indirect Graduate Medical Education (IME) on the Intern and Resident Information System (IRIS) report. However, they may be counted and included in a separate Medicare cost report worksheet; specifically, Worksheet E-3 Part II and III. Let’s first look at the history of why these residents were not included on the IME FTE count.

Prospective Payment System Established

In the past, teaching hospitals did not receive an IME adjustment for resident time spent in the IPF or IRF, because payments to these facilities were based on the facility’s reasonable cost under the TEFRA payment system. With the implementation of the Balanced Budget Refinement Act (BBRA) of 1999, inpatient psychiatric hospitals and distinct psychiatric units of acute care hospitals replaced the reasonable cost-based payment system with the Prospective Payment System (PPS). In 2001, CMS had the IRFs follow suit and established the PPS for IRFs.

CMS later adopted its proposed formulas for calculating IME adjustments for training residents in the IPF PPS 1 and the IRF PPS. 2 Teaching hospitals began receiving an IME adjustment for residents training in the IPF for cost reporting periods beginning on or after January 1, 2005, and for all IRF discharges on or after October 1, 2005.

CMS Implemented FTE Caps

In order to avoid creating incentives to artificially expand residency training in IPFs and IRFs, CMS implemented FTE caps for the number of FTEs a hospital can claim for both the IPF and IRF IME adjustments.

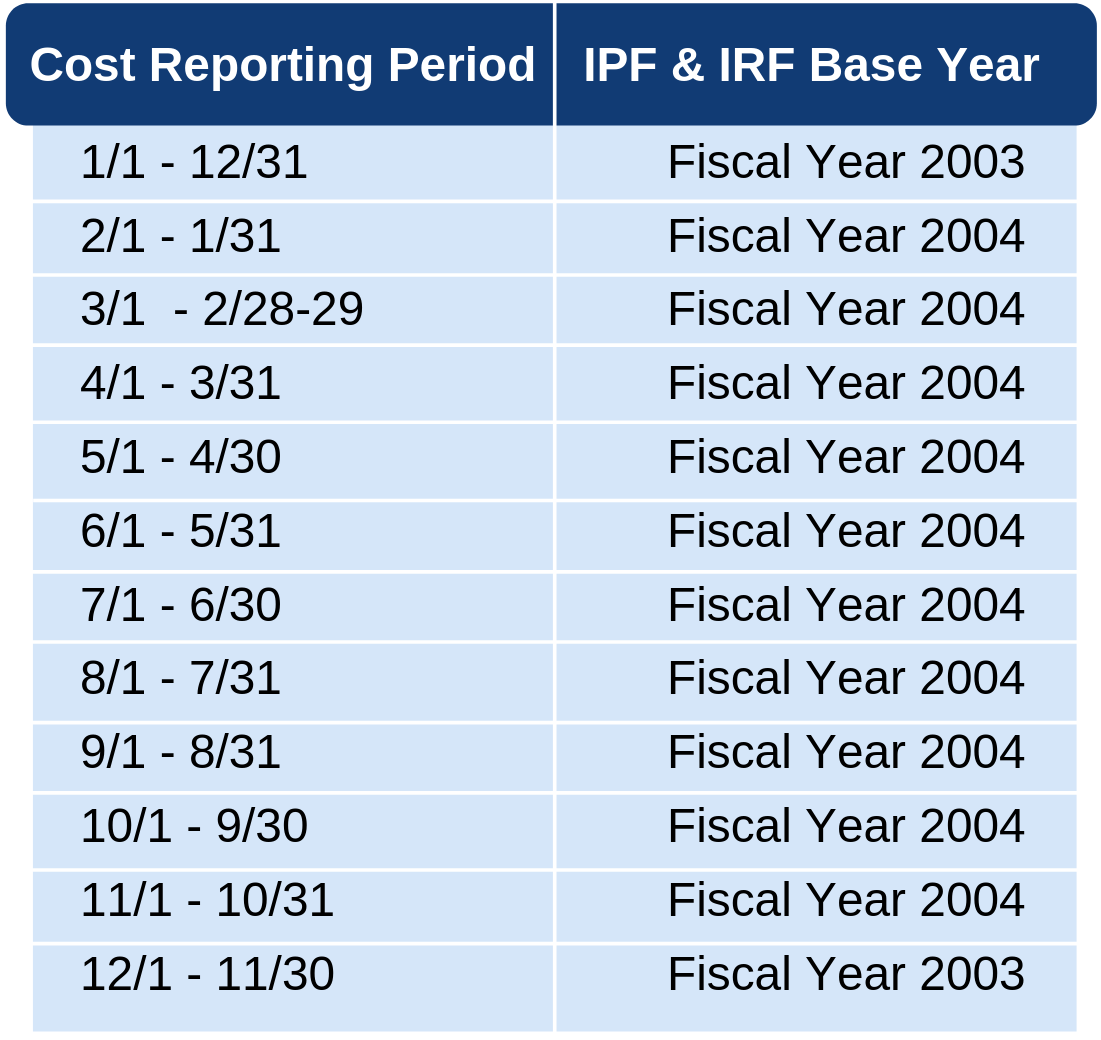

The “base year” for setting the number of FTE residents that can be counted toward both, the IPF IME adjustment and IRF IME adjustment is calculated by using the number of FTE residents that trained in the IPF and IRF based on the hospital’s most recently filed cost report before November 15, 2004. Below is a table showing which cost reporting period is the IPF’s and IRF’s “base year” based on the cost reporting period end date:

Consider the following to ensure your IPF and IRF FTE counts are accurate:

Check Rotations of All Programs

The Psychiatry and Physical Medicine & Rehabilitation residents are not the only residents rotating into the IPF and IRF. It is important to examine all residencies’ and fellowships’ rotation schedules to accurately account for all resident time in the IPF and IRF.

Reference the Square Footage Report

Reference the Square Footage Report to ensure you have identified the IPF and IRF units accurately. Not all Psychiatry and Rehabilitation areas of the hospital are part of the IPF or IRF and you risk a significant audit adjustment by assuming they are.

Do Not Claim IME on the IRIS for IPF or IRF Rotations

If a hospital does not exclude the IPF and IRF FTEs from the hospital’s IRIS report, there could be a significant disallowance during an audit. For one, if any of the IPF or IRF rotations are captured in the sample, the hospital may be faced with a disallowance based on an extrapolation. Additionally, the auditor then may not appropriately assign the correct IPF and IRF FTEs.

1 Federal Register, Volume 69, Number 219, Pages 66954-66956

2 Federal Register, Volume 70, Number 156, Pages 47928-47930

About the Author:

Sarah Ottesen

626-656-8312

sarah@gmesolutions.com